The Netherlands: More Mid-Market M&A Activity

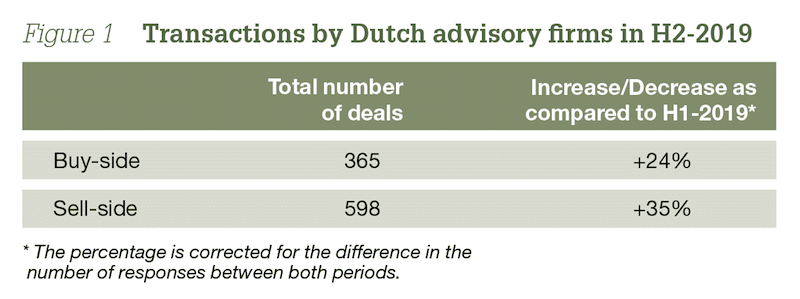

Mid-market M&A volume in the Netherlands was up 35 percent in the second half of 2019, as compared to the first half of the same year. The price level remained high (according to Dutch standards), with companies being sold at nearly five times EBITDA (enterprise value) on average. These are some of the findings of the “M&A Barometer”, a periodical survey conducted by Dealsuite and its Dutch sister company Brookz. The 262 participants in the survey are Dutch M&A advisors mediating deals between €1 and €30 million.

Steady increase

The rising M&A volume that is evident from the Dealsuite Barometer counters the narrative of an M&A market that is cooling off. Even if adjusted for seasonal effects —deal-making is usually slower in the second half of the year— the rise in volume is substantial. Compared to H2 2017, there is also a notable increase in smaller transactions with a deal value below €5 million. According to Dealsuite co-founder Floyd Plettenberg, the Barometer reflects longer-term trends in the Dutch M&A market. “We’ve been seeing a steady increase in deal volume for four years in a row now. In terms of deal value, there is an increase across all market segments. When we look at deal volume, the strongest rise is in transactions with a deal value under €5 million.”

Deal breakers

M&A advisors were also asked about the most common deal breakers. ‘A low offer’ (27%) scored highest, followed by ‘a lack of trust between buyer and seller’ (17%). Remarkably, in one out of four cases (26%), it is the advisor who is responsible when a deal bounces — by creating unrealistic expectations on the seller’s side, possessing insufficient knowledge about the business, or a general inability to come to an agreement with the advisor of the opposite party.

Outlook

The outlook for the first half of 2020 is still optimistic, though slightly less so than half a year ago. Over 81% (against 84% in H2 2019) of the advisory firms expect middle-market M&A to remain stable or improve over the coming 6 months. A minority of 19% expects a more challenging M&A climate. The firms rated the expected M&A climate in the first half of 2020 with a 7.5 (out of 10), against a 7.7 in H2 2020.

.svg)

.svg)

.svg)

.svg)